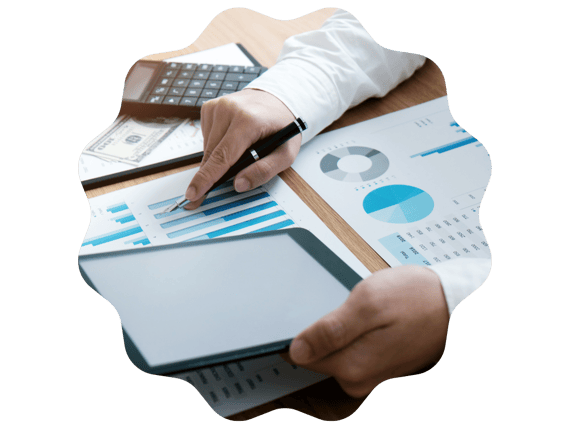

Corporation Tax Services

Taking care of the preparation

and filing of your company tax return

Let us deal directly with HMRC so you always pay the correct amount of tax — no more, no less.

We offer transparent, competitive pricing with no hidden fees, paired with outstanding customer support and proactive tax guidance.ent & RTI compliance

Transparent Pricing

Qualified Tax Advisors

Tax Planning & Business Guidance

Advanced Account Preparation

Corporation tax return (CT600)

All UK Limited Companies must file a Corporation Tax Return (CT600) with HMRC within 12 months of their accounting period end. However, any Corporation Tax due must be paid within 9 months and 1 day of the financial year-end.

At Boobooks, we handle everything from notifying HMRC to calculating your taxable profits and preparing your CT600 submission. With our expert tax planning, you’ll stay compliant while minimising liabilities.

Not sure when your company’s tax year ends? We’ll help you stay on track and avoid late penalties.

Penalties for late filing of the CT600 company tax return

Missing your Corporation Tax Return deadline can result in steep fines from HMRC:

1 day late – £100 penalty

3 months late – Additional £100

6 months late – 10% of your estimated tax bill (calculated by HMRC)

12 months late – Another 10% of the estimated tax bill

Avoid these penalties by letting Boobooks manage your Corporation Tax compliance — on time, every time.

Planning

Tax planning is probably the most crucial step. Our qualified advisors will help you determine the most tax-efficient business structure or equity planning.

Corporation Tax

What you will get from us

Tax Relief & Opportunities

Understanding all available tax reliefs and opportunities is critical. We will guide you through the process and ensure you receive all eligible benefits.

End to End Service

We will not only calculate your CT600 and submit it to HMRC on your behalf, but also answer any questions HMRC may have.